Written by Conrad Alvarado

Published on February 17th, 2024

On the road to retirement, financial planning is crucial to ensuring a comfortable and worry-free future. One of the strongest forms of long-term investment is the real estate market. However, not all properties are created equal, and choosing which type to invest in can make the difference between a peaceful retirement and one filled with uncertainty.

In this blog, we will explore different options and considerations for investing in property for retirement.

- Maybe you might be interested in: Why invest in Mahahual in 2024?

1. Residential rental properties

A popular option is to invest in residential rental properties. These properties offer regular income through rental payments, which can be a reliable source of income during retirement.

It is important to research the local market and look for areas with high rental demand, as well as carefully calculate the costs associated with ownership, such as maintenance, taxes and insurance.

2. Commercial properties

Commercial property, such as retail space, offices or warehouses, can also be a lucrative investment. They often generate higher incomes than residential properties, but may also require a larger initial investment and may be subject to longer vacancy periods.

It is essential to understand the local market and consider the type of business that will operate on the property to evaluate its potential for long-term success.

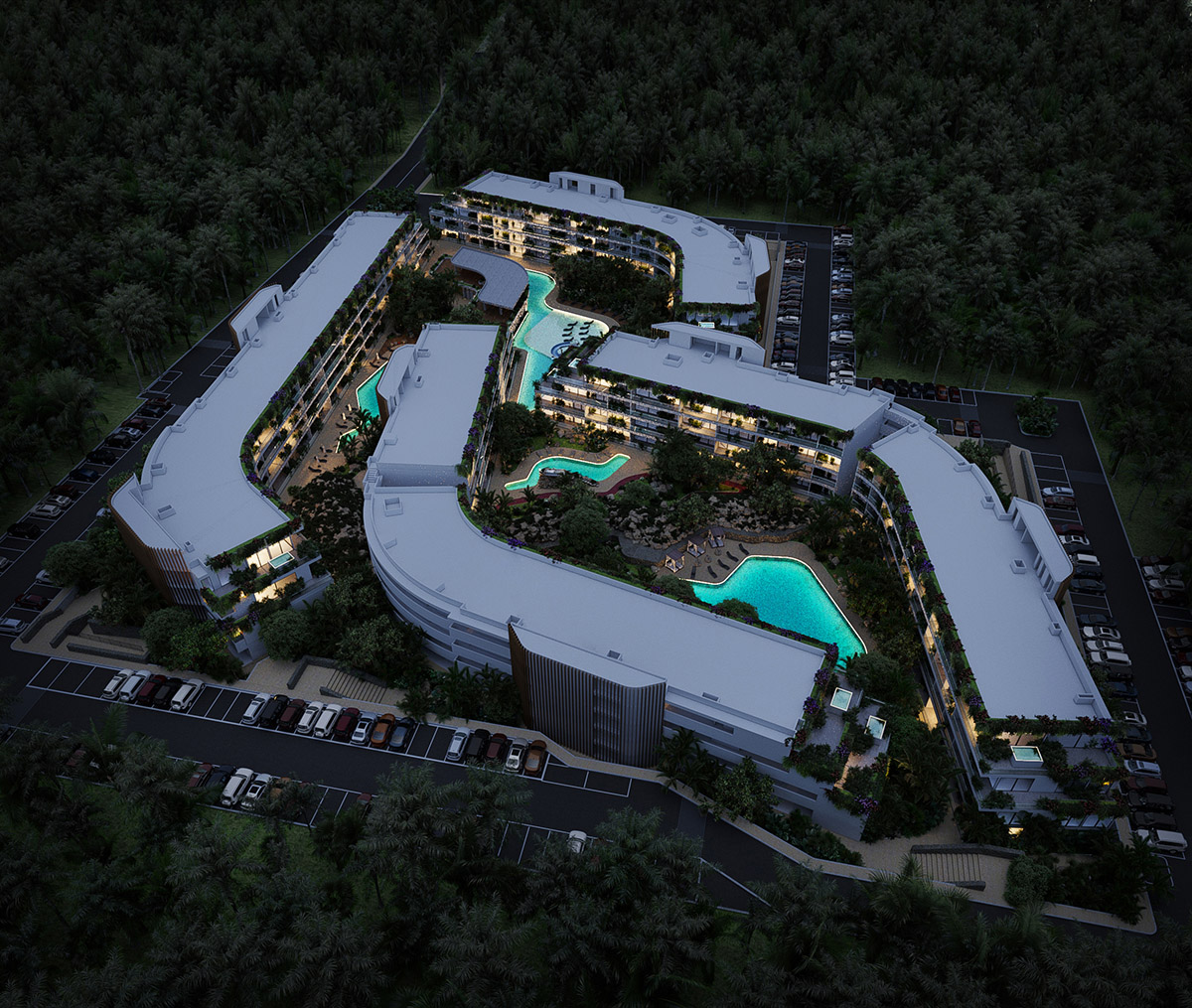

3. Vacation properties

Vacation properties, such as beach houses or mountain cabins, can offer a mix of rental and personal use income during retirement. However, it is important to take into account the seasonality of the market and the possibility of vacancy periods during certain times of the year. Furthermore, location and local tourist attractions play a crucial role in the profitability of this type of investment.

4. Indirect real estate investments

For those who want to invest in the real estate market without the burden of directly owning a property, there are options such as real estate investment trusts (REITs) or real estate investment funds (FIIs) . These investment vehicles allow investors to participate in the real estate market through the purchase of shares or interests in a professionally managed fund, providing diversification and liquidity.

Remember that investing in retirement property is long-term, so it is important to make informed and strategic decisions that will provide you with financial security in your golden years.

Before making any decision, it is essential to conduct extensive research and seek professional advice to maximize the potential for return on investment, such as what we offer at PIM Riviera Maya. Contact us and receive personalized advice!